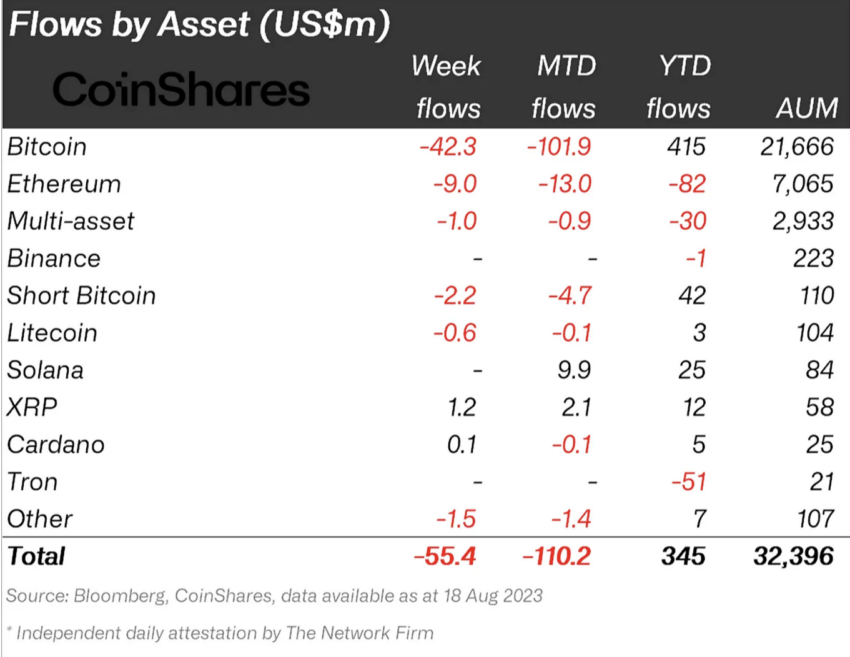

A new report from CoinShares suggests that the United States Securities and Exchange Commission’s (SEC) delay in making a decision on the approval of Bitcoin exchange-traded funds (ETF) has led to a significant Bitcoin sell-off.

“Disappointment from SEC ETF decisions has impacted sentiment,” the report declares.

SEC Uncertainty Leads To Sell-Off

Over the last week, the market has been impacted by the SEC’s delayed decision on the approval of a Bitcoin ETF, according to an Aug. 21 CoinShares report:

“We believe this is in reaction to recent media highlighting that a decision by the US Securities & Exchange Commission in allowing a US spot-based ETF is not imminent.”

The previous report for the week ending Aug. 11 highlights Bitcoin inflows amounting to $27 million, after three weeks of outflows. During the past week, Bitcoin has once again experienced a net negative sell-off:

“Bitcoin saw outflows totalling US$42m, reversing the inflows seen the prior week, while short-bitcoin saw outflows for almost the 17th consecutive week” the report states.

Sponsored

Sponsored

Ethereum Also Faces A Setback

It wasn’t just Bitcoin that took a turn. Ethereum, which in the previous week had inflows of $2.5 million, also returned to outflows:

“Ethereum saw US$9m outflows,” it states, despite reports that the SEC is looking to approve Ethereum Futures ETFs by as early as October.

Overall, digital asset investment products took a turn compared to the previous week, with outflows totalling $55 million. The previous week saw inflows totalling $29 million, noting the US inflation data being slightly below expectations.

“Polygon, Litecoin and Polkadot also saw outflows of US$0.9m, US$0.6m and US$0.5m respectively” it notes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Be the first to comment